Selling products online is always a big issue and it may become a very complicated process to learn first, and then solve.

I am sure many of us wish to take their services or products online be it digital or any physical products, but with the kind of paperwork or the technical aspects the available platforms demand, it seems like a drawback more than anything else.

Moreover, the easier to set up launch platforms are mostly available in other countries than India. As a result of which, the issue of currency conversion occurs which again demands some technical learnings.

What solved my issue?

Most of us were facing this issue and looking for a platform to sell our products online.

So a few months back, we came across Instamojo which is one of the simplest and safest payment gateways in India.

We have over a thousand transactions using Instamojo and the convenience is unparalleled.

What is Instamojo?

Instamojo means “Instant Magic” and as the name suggests, the gateway has been structured to service a massive market of digital product sellers, small businesses, freelancers, etc, and create magic in their lives.

The founders realized the issues the Indian market was facing and sensed that India is a place where small businesses sustain but are not much into technical stuff.

Therefore, Instamojo was created with the goal to develop a payment gateway that anyone can use without any technical knowledge.

Yes! That means, no complicated paperwork and even more, no website is required.

According to the founder of Instamojo, Sampad Swain, “Digital payments platform bundled with tons of e-commerce features to enable any business or individual to sell, manage & grow effortlessly, securely and cost-effectively.”

Why Instamojo?

Let me quickly run you through some of the numbers that Instamojo has achieved:

- In the year 2019 Instamojo has crossed more than 700,000 customers all over the country.

- The platform has more than 250,000 active merchants.

- As of now, the platform has 60,620 online stores that have over 6,62,880 products hosted.

- The total transaction volume has grown by 78% – a clear indicator of merchant trust and ease-of-use of the platform.

- Interestingly 65% of visitors are from non-metro cities like Patna, Kochi, Lucknow, Nashik, etc – this goes on to show that digitization is reaching beyond Indian metros.

These are just a few numbers to emphasize the impact that Instamojo has made on the small businesses in India.

But are these numbers enough to tell why to go for Instamojo?

Of course not.

The point Instamojo was developed because the traditional method of online payment is very critical and not so user friendly.

If you want to sell product using online payment process here is what you will have to do:

STEP 1: Open a business (corporation, propertiorship, etc.)

For a person who needs to sell products online, you need a registered firm or an organization. This again involves a lot of paperwork. Also if you just want to sell a simple product like an e-book or a webinar service then there is no way you could sell using a traditional payment gateway system.

STEP 2: Create a website following compliance.

Again for the confirmation of your firm you need a website of the firm and hence have to put a lot of money to build it and always keeping it updated with the new information.

STEP 3: Create all business policies and places on the website.

Thirdly you need to build your business policies i.e. the guidelines developed to govern the action of your organization. And not just that you also should update those guidelines on your website so that your user will be aware of them.

STEP 4: Contact payment service provider.

Now you need to talk with the payment service provider who offers shops the online services for accepting electronic payments by a variety of payment methods i.e. debit card, credit card, or net banking. You need to contact them and inform them about your business.

STEP 5: Submit paperwork.

And here comes the critical part. Now you have submit paperwork about you, your business, and all the other bank details and information in a systematic format so that your information can be sent for the verification.

STEP 6: Wait for verification.

Now once you have submitted all the paperwork you will have to wait for the verification of your documents and your bank details. All your paperwork will be checked by the authorities. Until the verification completes you will have to wait for the approval.

STEP 7: Go back and forth with the provider for approval.

Now you will have to connect with the provider, again and again, to check on your verification so that you could move to the next step. And if there occurs some errors with the documents or information provided then you will have to rectify them. I don’t feel I need to explain to you how tedious the document job is.

STEP 8: After approval, have the tech team implement the payment gateway on the website.

Once you are done with the approval now you will have to ask your technical team to sit for the implementation of the payment gateway on your website. Your technical team will have look into the process and then sort out the procedure to embed the system on your site so that the buyer and you both will not face any payment issues on your ends.

STEP 9: Start selling.

Once you are done with all these things then you will be all set to sell your products.

A great amount of work. Right?

This procedure is great for someone who has a good amount of investment and wants to build a huge business.

But what about somebody who just wants to sell an e-book?

Now let me very quickly tell you about how to sell products on Instamojo.

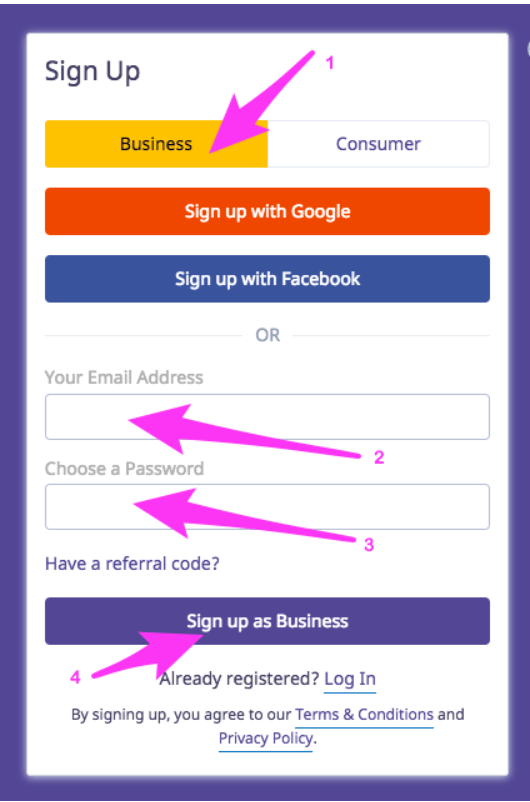

STEP 1: Create an account.

Creating an account on Instamojo is very simple. All you need to do is click on sign up and either create an account with Google, Facebook, or either by entering your email address.

And once you sign in as business your business account is ready.

STEP 2: Upload basic documental information.

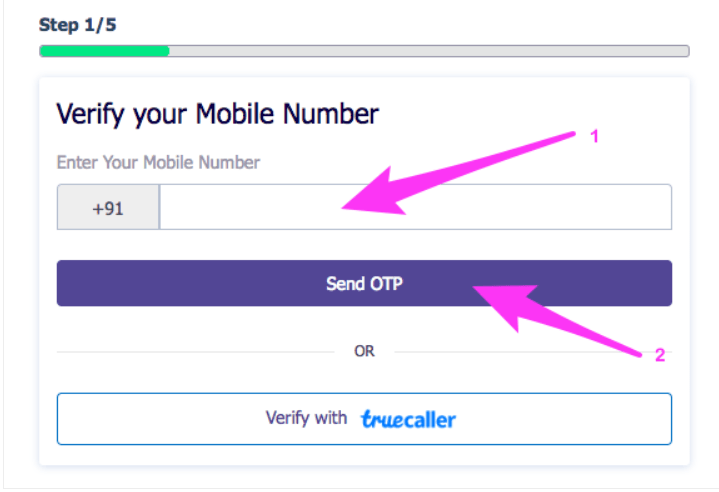

After that, the next step is uploading some of the basic information that will let you set up your account and manage the transfer of money for every transaction.

First, you need to enter your mobile number and verify it using OTP.

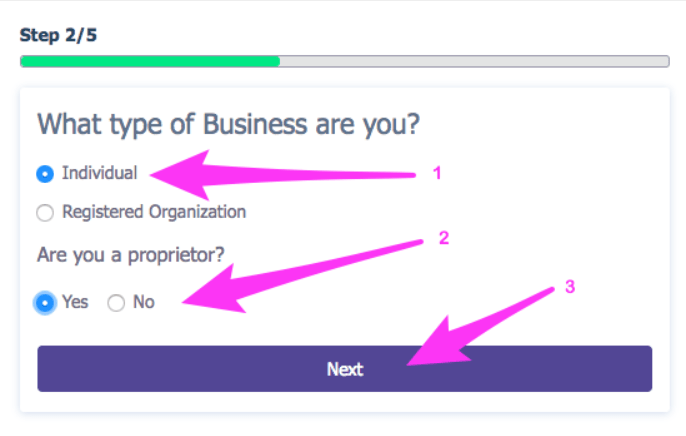

Secondly, give the preference for the type of business you are.

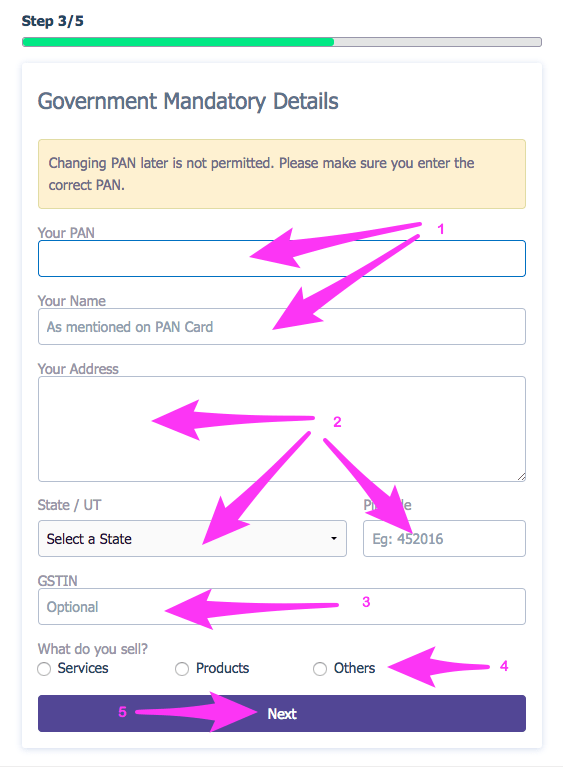

Here are a few things that are required for the official government process. You need to provide your pan card details, your brief address, GST number if you have any and select the option about what are you going to sell.

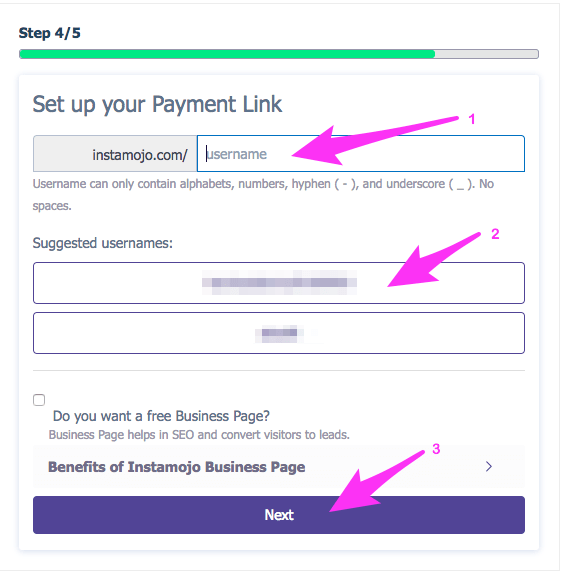

You get an option to make your customized payment link according to your username.

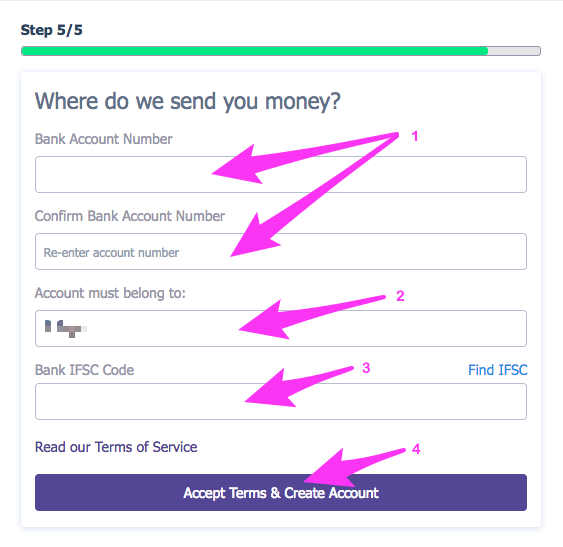

This is the last step where you will have to give your bank information so whenever you will receive any transaction it will be directly deposited to your account.

And here you are done with creating your instant business online.

Setting an online store on Instamojo is just a work of 30-45 minutes max to max.

STEP 3: Start selling.

Yes, that’s it. Once you create an account and upload the documents you are all set to sell your products. You can upload some images of your product, give a proper description of your product and set the price of the product.

Even you will get the choice to select the interface of your product display.

You can upload as many products as you want on Instamojo.

Now still if you doubt how can you do it then you should read the next line which was mentioned on the official website of Instamojo.

“Over 30% of our merchant base is now actively using the platform, which is a huge feat for Instamojo. We are a DIY (do-it-yourself) platform and about 85% of our merchants self-onboard. This reflects the simplicity and intuitive nature of our platform.”

The Growth

The co-founder Sampad Swain in one of his interview said that:

“My idea was to enable people to collect money from their friends and families by creating a short link and sharing it with them. It was simple and a lot of interesting things could be done on top of it.”

Initially back in 2012 when the idea of Instamojo was in the mind of Sampad it was just about creating a payment gateway.

But with the constant hard work and innovative ideas, it has now transitioned from being just a payment gateway to being a growth facilitator for small businesses and freelancers.

Instamojo security

The security of the transactions via online payment gateways is one of the most essential things you must look for, while selecting one, to integrate with your business.

As it is your sole responsibility to keep the purchasing process under control and reduce the risk of fraud transactions at every step of checkout, here’s how Instamojo payment gateway can help you:

Instamojo uses the following security:

- 128-Bit Encryption (AES):

Here, AES stands for “Advanced Encryption System” and speaking in a nutshell about AES 128-Bit Encryption, it will give absolutely high-end protection to your transaction data and details.

Moreover, The EE Times points out that even using a supercomputer, a “brute force” attack would take one billion years to crack AES 128-bit encryption.

- PCI-DSS compliant:

To ensure further security of any payment gateway, you can check whether or not the platform is PCI-DSS compliant.

PCI-DSS stands for “Payment Card Industry Data Security Standards” and the companies that follow and achieve this standard are considered to be PCI compliant.

And for knowledge sake, PCI DSS has six major objectives, 12 key requirements, 78 base requirements, and over 400 test procedures, which fortunately Instamojo have passed.

So, by now, it’s pretty much clear why to go with Instamojo.

Why do I recommend Instamojo for small businesses/solopreneurs

1. Quick setup

Instamojo, really made the payment account set up a piece of cake, which as a seller, you just need to grab and eat it.

Basically, it doesn’t require a ton of documents with your signature to set your payment account. Rather, it just needs your personal info, PAN number, and bank account details that you want to link for payment purposes.

And obviously, an e-mail id.

With just these simple documents and details, you can easily set up your Instamojo account in a few minutes.

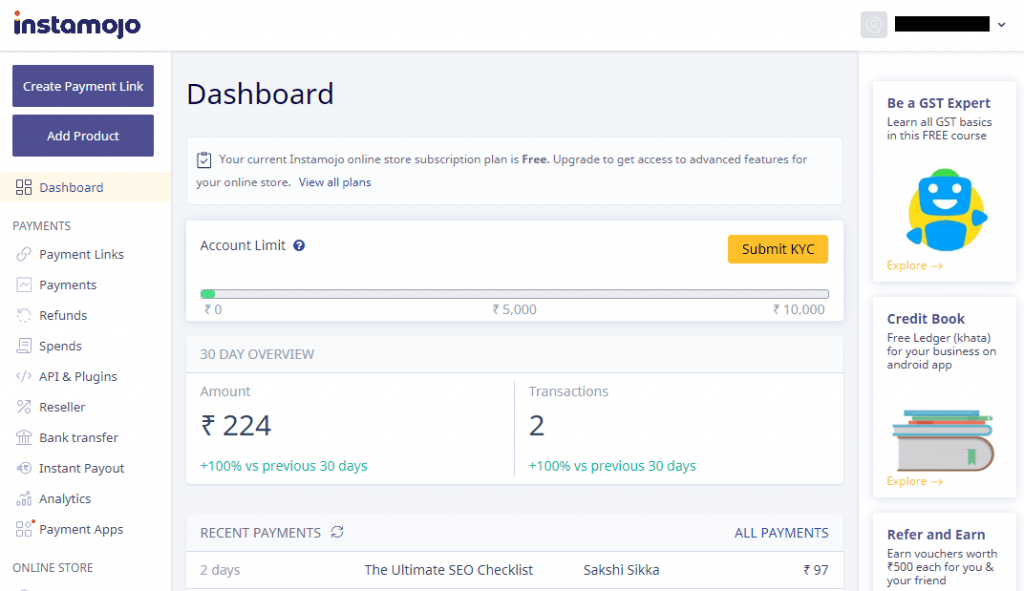

2. Easy to use and super friendly UI

Generally, the business people don’t want to go into the technical aspects of order and checkout procedures. And fortunately, with Instamojo, you don’t need to do that as well.

Keeping the goal in mind, Instamojo offers a super user-friendly dashboard from which, even a 12-year-old can build an online store, add products, and manage the orders and transactions of customers.

3. Create an online store with few clicks (new feature)

With the ease of Instamojo, one can create his online store in a stupid-simple process of hitting a few buttons and entering basic details regarding the shop.

Instamojo also includes its services like the:

- Add to the shopping cart and checkout features

These are the features that will give a classic add-on to your online store and will definitely build a sense of trust among your prospective customers.

- Shipping service (with mojo express)

Now, this is the most required feature which is one of the best features that I came across in Instamojo.

If you are a seller of digital products such as e-books, courses, etc, Instamojo is the best fit for you, as we have discussed so far.

However, even if you sell physical products; Instamojo has taken care of it too.

Your product could be delivered for over 26,000+ postal codes with a very little charge, but without any stress.

4. No need for a website

As I have mentioned multiple times that, no technical knowledge or a website is required to get started with your own business on Instamojo.

You can simply create your super amazing online store, add your digital or physical products, promote it, and generate revenue.

5. Share your payment links easily via WhatsApp, SMS, E-mail, etc

You can easily share the payment links (of products or for simple payments) with your clients, colleagues, or strangers to get them to pay you.

6. Wide payment options

In addition to easy sharable payment links, Instamojo offers a huge range of payment options to your payee and includes almost everything (from cards to UPI to 3rd party apps) through which one can pay.

7. A very low transaction fee

While activating your payment account on Instamojo, you don’t have to pay a setup fee, or signup, integration cost, AMC, or any other fees.

However, Instamojo will charge a very minimal transaction fee + GST at the time when your payee will checkout.

The Instamojo charges range from 0-5% + Rs. 3, depending upon the model of the transaction (like NEFT, card payment, Gpay, etc.)

Here, you can know about the charges in detail.

8. Awesome and really helpful support

For me, this is the best thing that Instamojo provides – a high end and 24/7 active support.

While running an online business, you will surely get hooked by some software issues, customer side problem, invalid checkout session, and many more.

And the only place where you can head up to solve any transaction related issues is the support service of the company.

9. The young, hungry team that aligns with small business

On Instamojo, once you create your payment account, you can also add multiple users (or teammates) who can then handle that work for you easily.

These are some of the best features that Instamojo provides, even in its FREE plan, with a few limitations that we will discuss later.

10. More features by Instamojo

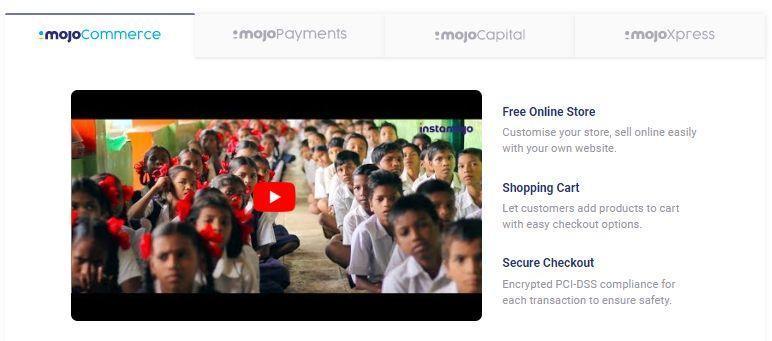

mojoCommerce

MojoCommerce service will help you to build your free customized online store easily and will add a shopping cart option in your store which will create a sense of trust among your customers.

Moreover, it will also provide the secure checkout pages encrypted with PCI-DSS compliance for safe transactions from your customer end to your end.

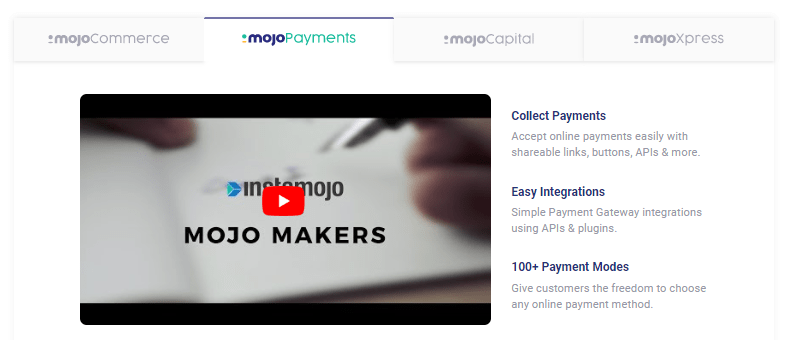

mojoPayments

mojoPayments make it easy to integrate payment gateway using APIs and plugins to your website and lets you collect payment directly from your customer to your Instamojo account.

In addition, it also offers almost every possible payment option your customer can use.

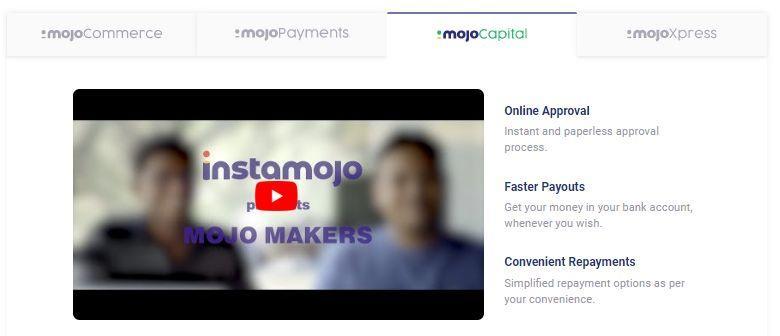

mojoCapital

This service will ease your refund process and will get you instant online approvals.

mojoCapital service will also enable you to get your hard-earned money in your bank account from Instamojo, anytime according to your convenience.

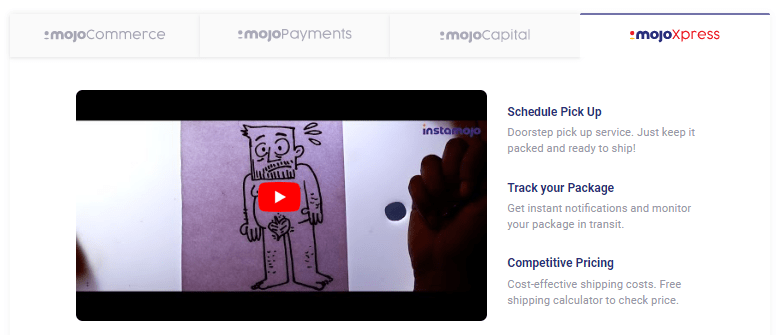

mojoXpress

This service provides you the facility of scheduled doorstep pickups and also helps you to track your packages accurately.

Some things I would improve on Instamojo

1. Comparatively long pay-out time

Once your payee pays you for your product or service, it shows in the Instamojo dashboard.

But, it takes almost 3 business days for Instamojo to transfer the received amount to your bank account which is comparatively slow.

In my view, Instamojo must reduce the pay-out time from 3 business days to 1 business day, which will eventually help small business owners to keep rolling their business effectively.

However, this is possible with mojo capital, but only if you are eligible.

2. Online store features are not up to the mark

The features discussed above are very well managed and will definitely be very helpful but are not customizable compared with the dedicated online store providers.

Instamojo should definitely work on these features so that more customization would be possible while creating the online store.

3. Instamojo WordPress plugin hasn’t been updated

Nevertheless, Instamojo does have a WordPress plugin to integrate the power of your website and ease of Instamojo payment gateway to accept payments but has not been updated for long.

Also, you will not be able to create a customized checkout page for the customers that suits the theme and feel of your website.

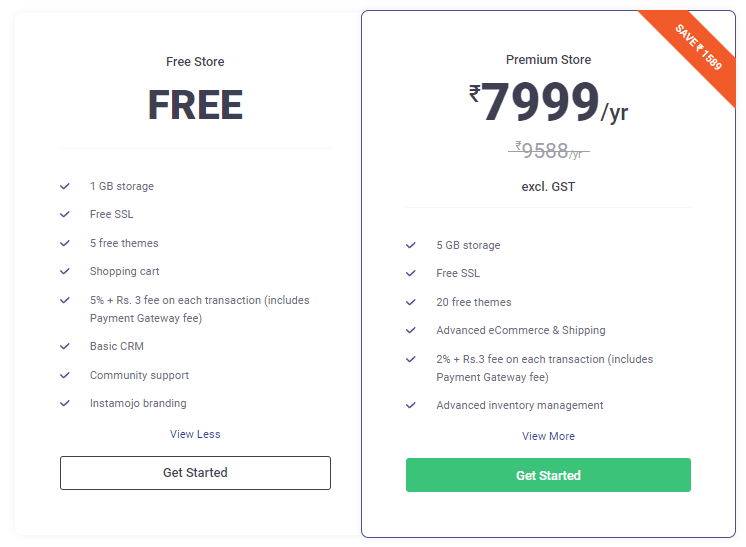

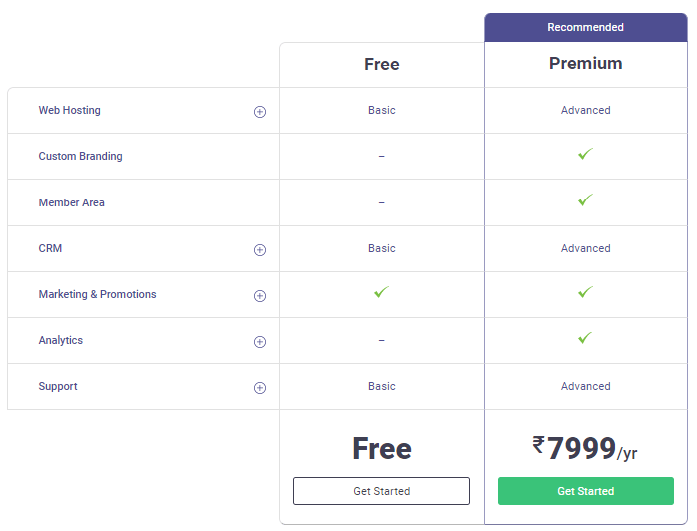

Instamojo Pricing

Instamojo charges you in two ways; the first one is the transaction fees (which we have discussed above), that you can’t escape off, and, other is while setting up your online store which depends on your choice, whether you want to have the super features or not.

Now, if you want to scale your business, or if you have a good customer base, then you should definitely opt for the premium plan.

With the premium plan, you will get 4GB extra storage with 20 amazing ready to use themes + advanced eCommerce, shipping, and inventory management which will really count and will save a huge chunk of your time.

Here is the detailed comparison between the free and premium plan.

The decision of whether to go with a free store setup plan or to opt for a premium store setup plan could depend on loads of factors.

However, in my advice, if you aim to give the best site-wide experience to your customers so they become your advocates and spread word-of-mouth, then, you should surely opt for a premium plan without any hesitation.

Conclusion

To sum up, I would admit that for the Indian market that is growing exponentially Instamojo payment gateway will act as a boon to all the people who ever wanted or may want to sell products and services with ease.

Now, when you know every bit about Instamojo and its functionalities, I would love to hear from you.

Are you running an online business or going to take your business online?

And what are your views on Instamojo as a payment gateway?

Lemme know by commenting below. 🙂