While driving in my car today, I just searched on YouTube for ‘secrets of the millionaire mind’ by T.Harv Eker as apart of my daily personal development routine.

As I stumbled and listened to some audios from a recorded LIVE seminar of his, I got this really awesome way to manage our money better.

Personally, my money management has been haywire. On some months I have total control over my personal accounts and on some months I lose track of my exact cashflow.

Why Should We Manage Our Money Better?

T Harv Eker gives the example of a kid who drops his ice cream scoop down on the floor and asks his parents to get him another one. As they walk towards the ice cream booth, the kid sees a ‘triple scoop’ signboard and asks his parents for the triple scoop. Knowing well that he struggled to handle the single scoop ice cream.. his parents did not get him the triple scoop.

The moral of that simple example is that if we are not able to manage our personal finances well, then there is really no question the universe is going to shower us with more wealth.

This was a profound yet simple example which helped me realise that I need to start managing my money the T Harv Eker way!

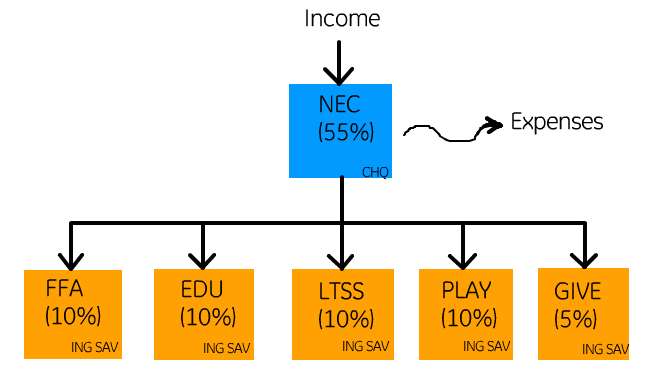

The 6 Jars Method

Anyone can start using this JARS method of managing their money even though if you think you do not have a lot of money to manage. The key is to develop a habit of managing your money, but not how much money you have available for you to manage. One must get into the habit of managing their own money, and you can start with as low as $1 to begin using this system.

How we are supposed to break up our month budget into the 6 categories are as follows:

- FFA (Financial Freedom Account) – 10%

- LTSS (Long Term Savings For Spending) – 10%

- NEC (Necessities) – 55%

- PLAY (Indulge in yourself) – 10%

- GIVE (Charity) – 5%

- EDUC (Education) – 10%

[su_button url=”http://sidz.co/lifestyle” target=”blank” style=”3d” background=”#ef522d” size=”9″ wide=”yes” center=”yes” desc=”Here’s Why Most Entrepreneurs Are Choosing A Different Franchising Method To Make More Revenues Thru The Same Efforts. CLICK HERE To Learn More.”]Struggling To Make Money? Here’s The SOLUTION![/su_button]

1. FFA Financial Freedom Account (10%)

This is your wealth building account. Also know as your “golden goose” This follows the “pay yourself first” financial principle. The money that you put into this jar is used for investments and building your passive income streams. You never spend this money. The only time you would spend this money is once you become financially free. Even then you would only spend the returns on your investment. Never spend the principal.

In summary, the time to spend your FFA capital is NEVER! When you stop working, you get to spend the eggs but never the goose!

2. LTSS Long Term Savings For Spending (10%)

Put 10% into your LTSS whenever you receive money, such as your salary. The money inside LTSS can be used for major expenditure such as savings for your children’s education, buying a house for yourself, keeping aside contingency funds. This is the money that you put aside for big purchases like cars, vacations, etc. This account can also be used as an emergency fund.

3. NEC Necessities (55%)

This is for your everyday expenses like gas, rent, utilities, etc. This is the money that you use to “survive” on. If you cannot survive on 55%, simplify your lifestyle. Instead of driving a car, perhaps you can take public transport, or drive a Honda instead of a BMW. Buy Converse jeans instead of Armani. There are people who cannot live on 50% NEC when they started the JARS system but over time, these same group of people are able to simplify their lives and live on 50% or lesser!

4. PLAY Reward Yourself (5%)

You are supposed to spend this money every month to pamper yourself. The key is to BLOW this Play money away every month so that you will feel good about having money and spending it! You should feel guilt-free when you spend this money every single month.. This is the money that you have fun with. In the book, T. Harv Eker recommends that you spend this money on luxurious things. This is designed to bring balance to you finances so you will be increasing your wealth and having fun at the same time. You can go shopping or even eat at a nice restaurant. It is highly recommended that you spend this money every month!

5. GIVE Charity & Donations (5%)

You can use the money for donations to charities, use it to help someone in need. Giving is important. Giving is a critical financial principle to your success.

6. EDUC Education (10%)

Put 10% into your EDUC whenever you receive money, such as your salary. You can use the EDUC funds for your self-education, for examples, books, seminars and events etc. Everyone needs to learn, especially in this changing world. Grow your comfort zone through learning and doing. If you are not growing, you are dying! Take this quote from Ben Franklin: “If you think education is expensive, try ignorance!”

[su_button url=”http://sidz.co/lifestyle” target=”blank” style=”3d” background=”#ef522d” size=”9″ wide=”yes” center=”yes” desc=”Here’s Why Most Entrepreneurs Are Choosing A Different Franchising Method To Make More Revenues Thru The Same Efforts. CLICK HERE To Learn More.”]Struggling To Make Money? Here’s The SOLUTION![/su_button]

How To Implement The 6 Jars System

There are 2 ways you can do this.

- Buy 6 Jars for your home and put in the money every month in each of those jars.

- Setup 6 Bank Accounts separately and allocate your funds going into each of those accounts.

In my opinion, this is really a great Money Management System as it covers most aspects, if not all, on how one usually spend their money. It is so amazing simple, yet profound, method of better managing your money, regardless of how much money you already have!

It can work for people who never save their money, or for people who needs to give to feel a sense of contribution to others/society, for those that need to learn and grow through learning, for anyone who just needs a little more help in managing their money.

I highly recommend T. Harv Eker’s Money Jar system to anyone who wants to obtain financial freedom.

If you enjoyed this post, please share, like and comment below.

14 replies to "Manage Your Money Better Using T.Harv Eker’s Jar Method"

thanks for giving a tips for millionaire minds,and goodrich for this futures someday?

Welcome Magnus. All the best putting it into practice.

Dear Sidz I am extremely impressed with the 6 Jars Savings. Everyone should start immediately to achieve Financial Freedom since this is a Proven Fact. Thanks.

C.V.Subraamanian Iyer

Thanks for your words. Yes, if we implement it we can surely see the results.

Awesomely described 6 Jar system. THank you for sharing

You’re welcome Nik. Have you started to implement this system?

Thanks Sid!

Dear sid,

As you mentioned earlier,i am in that stage where i am still trying to figure out money management.

It is a great idea and i will surely try out the same.

Thanks

Yes Malini. This system will definitely change your perspective on money management. All the best!

Extremely good article, I am sharing this with my clients.

Thanks Mr.Prasad! Please do share it with your clients.

Hi Siddharth ,

How to apply this system if i am an entrepreneur from the monthly income varies 7 how do i take my money to re-invest on my business.

Thank you

Ronakgajjar

Thanks for sharing this knowledge.

Thanks a ton! Glad to serve you!